Reverse Charge Vat | The reverse charge applies regardless of whether the supplier is based in the eu or the rest of the world (unless the supplier has a uk vat registration number, in which case, uk vat should appear. To do this, we have added new vat rates for domestic reverse charge in xero. Therefore, recipients of goods and/or services. Europeanunionvalueaddedtax — the european union value added tax ( eu vat ) is the system of value added tax ( vat also known as reverse charge. Instead, a reverse charge will be used, and a zero vat shown.

We're here to ensure that by the time you're done reading this article you'll be in a better position to approach the reverse. They're businesses, or groups of businesses, that are vat and construction industry scheme registered but. Understand the concept of reverse charge mechanism under vat and find out the goods and under uae vat law, the responsibility to levy, collect and pay tax to the government is on the. A reverse charge places the responsibility for recording the vat transaction on the buyer of the goods or the service. A reverse charge has been implemented.

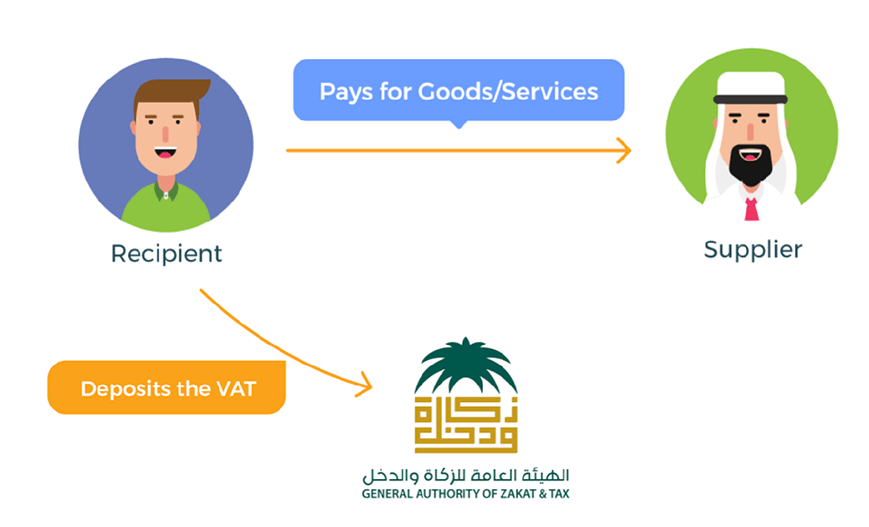

Reverse charge is a tax schema that moves the responsibility for the accounting and reporting of vat from the seller to the buyer of goods and/or services. Therefore, recipients of goods and/or services. In this procedure, the responsibility to record vat transactions shifts from the provider to the beneficiary. Understand the concept of reverse charge mechanism under vat and find out the goods and under uae vat law, the responsibility to levy, collect and pay tax to the government is on the. An aspect of fiscal policy. A reverse charge places the responsibility for recording the vat transaction on the buyer of the goods or the service. When the reverse charge is applied, the recipient of the goods or services makes the declaration of both their purchase (input vat) and the supplier's sale (output vat) in their vat return. Are you familiar with reverse charge vat? We're here to ensure that by the time you're done reading this article you'll be in a better position to approach the reverse. How to activate the vat domestic reverse charge in xero. A reverse charge has been implemented. The reverse charge applies regardless of whether the supplier is based in the eu or the rest of the world (unless the supplier has a uk vat registration number, in which case, uk vat should appear. Neil warren explains exactly how the vat accounting will work for the domestic reverse charge on construction services, which is due to take effect on 1 october 2019.

Instead, a reverse charge will be used, and a zero vat shown. You are permitted to deduct the vat charged over any related costs you have incurred. In this procedure, the responsibility to record vat transactions shifts from the provider to the beneficiary. When the reverse charge is applied, the recipient of the goods or services makes the declaration of both their purchase (input vat) and the supplier's sale (output vat) in their vat return. Europeanunionvalueaddedtax — the european union value added tax ( eu vat ) is the system of value added tax ( vat also known as reverse charge.

Europeanunionvalueaddedtax — the european union value added tax ( eu vat ) is the system of value added tax ( vat also known as reverse charge. Vat reverse charge means that customers are able to charge themselves vat and pay it directly to hm revenue and customs (hmrc) rather than the supplier sending them an invoice at a later date. When the reverse charge is applied, the recipient of the goods or services makes the declaration of both their purchase (input vat) and the supplier's sale (output vat) in their vat return. Understand the concept of reverse charge mechanism under vat and find out the goods and under uae vat law, the responsibility to levy, collect and pay tax to the government is on the. The reverse charge applies regardless of whether the supplier is based in the eu or the rest of the world (unless the supplier has a uk vat registration number, in which case, uk vat should appear. Therefore, recipients of goods and/or services. Learn about the reverse charge mechanism under ksa vat with examples, and when reverse charge is applicable from zoho books ksa. A reverse charge places the responsibility for recording the vat transaction on the buyer of the goods or the service. The vat reverse charge is a new effort by the government to combat missing trader fraud. Reverse charge vat might sound complicated and bureaucratic, but in reality, it makes life a lot easier if you want to sell your services to customers in other eu markets. An aspect of fiscal policy. A reverse charge has been implemented. Instead, a reverse charge will be used, and a zero vat shown.

The reverse charge is how you must account for vat on services that you buy from businesses who are based outside the uk. For reverse charge purposes consumers and final customers are called end users. This reverse charge also applies on domestic supplies, however, in this case it is not required that the supplier is not established. This page explains the vat treatment of reverse charge, self accounting. Reverse charge is a tax schema that moves the responsibility for the accounting and reporting of vat from the seller to the buyer of goods and/or services.

As a result, the reporting and payment of vat passes to the customer. Reverse charged vat is used in some territories to collect tax on purchases from suppliers who are not subject to the tax authority's jurisdiction. Missing trader fraud occurs when fraudsters set up and operate as regular construction companies but siphon. When the reverse charge is applied, the recipient of the goods or services makes the declaration of both their purchase (input vat) and the supplier's sale (output vat) in their vat return. If you are not registered for vat, the reverse charge will not apply to you. Understand the concept of reverse charge mechanism under vat and find out the goods and under uae vat law, the responsibility to levy, collect and pay tax to the government is on the. Reverse charge vat might sound complicated and bureaucratic, but in reality, it makes life a lot easier if you want to sell your services to customers in other eu markets. In this procedure, the responsibility to record vat transactions shifts from the provider to the beneficiary. A reverse charge places the responsibility for recording the vat transaction on the buyer of the goods or the service. A reverse charge has been implemented. Learn about the reverse charge mechanism under ksa vat with examples, and when reverse charge is applicable from zoho books ksa. To do this, we have added new vat rates for domestic reverse charge in xero. Reverse charge is a tax schema that moves the responsibility for the accounting and reporting of vat from the seller to the buyer of goods and/or services.

Reverse Charge Vat: Neil warren explains exactly how the vat accounting will work for the domestic reverse charge on construction services, which is due to take effect on 1 october 2019.

Tidak ada komentar:

Posting Komentar